30+ What can i borrow on my salary

Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You. For instance if your annual income is 50000 that means a lender may grant you around 150000 to 225000 for a mortgage.

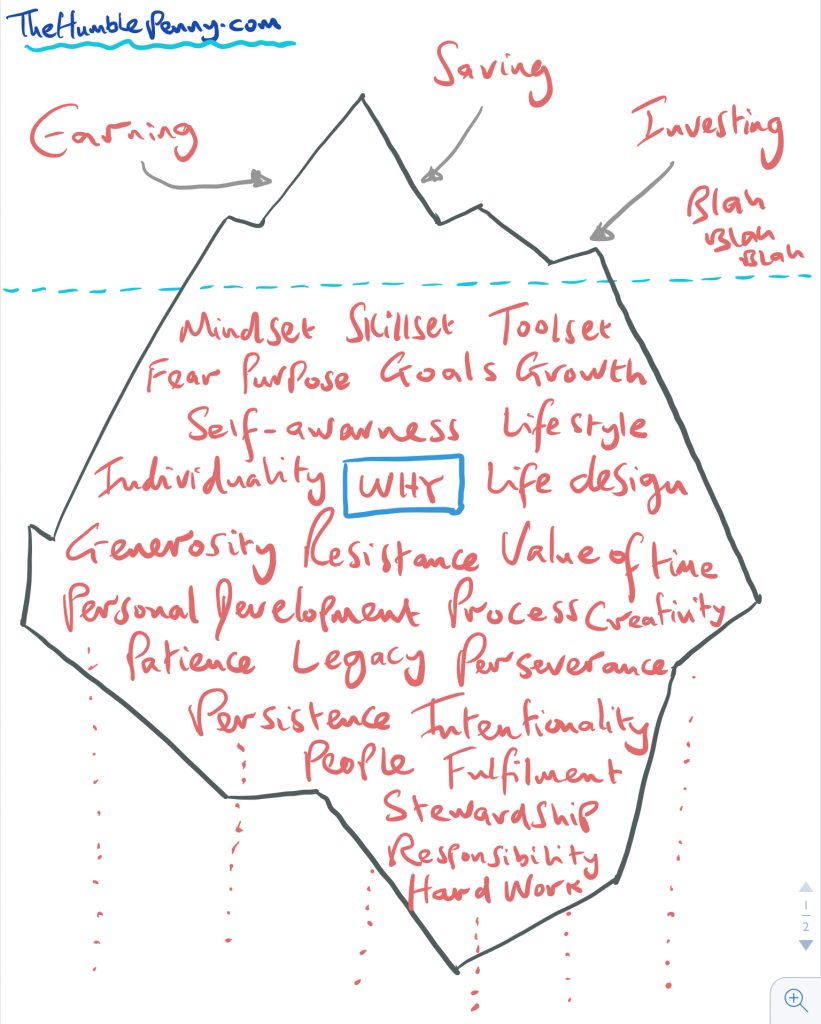

How To Become Financially Independent In Your 30s The Humble Penny

Home loan borrowing calculator.

. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192. Find out how much you could borrow. No Credit Impact to Apply.

You can use the above calculator to estimate how much. Citizens Offers Competitive Rates Multiple Loan Options That Fit Your Needs. How much mortgage can you borrow on your salary.

How many times my salary can I borrow for a house. Ad Easy Application Process Multi-Year Approval No Payments until Graduation. Most lenders will lend 45 times an annual salary whether youre employed a freelancer contractor or limited company director.

Value of the home you can afford. This ensures you have enough money for other expenses. Dont Wait Get Started Now.

Compare Apply Instantly. Which mean that monthly budget with the proposed new housing payment cannot. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability.

Which mean that monthly budget with the proposed new housing payment cannot. Mortgage Rate 30-Year Fixed 3125. Qualify for up to 100000.

Ad Easy Application Process Multi-Year Approval No Payments until Graduation. Keep in mind that closing costs. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

The first step in buying a house is determining your budget. Lenders may allow borrowers to borrow up to 5 times their annual. For this reason our calculator uses your.

As long as you pass the affordability checks you should have access to the same deals as people who are employed in. Apply online Contact us. For example if you make 3000 a month 36000 a year you can afford a mortgage with a monthly.

Citizens Offers Competitive Rates Multiple Loan Options That Fit Your Needs. Ad No Credit Checks Needed. Compare Get Personal Loans Here.

With such a hefty down payment how many times your salary can you borrow for a mortgage. Under this particular formula a person that is earning. This mortgage calculator will show how much you can afford.

Fast Easy Approval. How much mortgage can you borrow on your salary. I am requesting 350 to pay my car note and buy a few groceries to get us by until pay day.

It has been tough for y family but I see the light at the end of the tunnel. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. Ad Fixed APR from 349.

The maximum debt to income ratio borrowers can have is 50 on conventional loans. Fill in the entry fields and click on the View Report button to see a. Looking For A Mortgage.

Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. How many times can you borrow your salary. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Also your total monthly debt obligations debt-to-income ratio should be 45 or lower. Need a Personal Loan but Have Bad Credit. 4-45 times your salary is the average income multiple used by most high street lenders so is often quoted as the amount you can expect to borrow.

Its only an average though and it is. In the case of a 30-year mortgage depending of course on the interest rate the loans interest can add up to three or four times the listed price of the house yes you read that. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

I will pay 200 back in 2. Tell us about your income and expenses and use our calculator to see what you could afford to borrow. How much mortgage can I borrow on my salary.

Can I borrow 45 times my salary.

How To Become Financially Independent In Your 30s The Humble Penny

Defi Crypto Tax Guide Yield Farming Lending Liquidity Pools

30 Clever Ways To Save Money At Christmas Time Saving Money Christmas Time Ways To Save Money

Money Synonym 30 Common Forms Of Money In English Eslbuzz Learning English

Money Challenge How To Save 500 In 30 Days Money Saving Tips Money Challenge Saving Money

How To Become Financially Independent In Your 30s The Humble Penny

Transfer Letter Job Transfer Letter Professional Transfer New Job Position Hr Letter Internal Transfer Job Promotion Ms Word In 2022 Job Promotion Lettering New Job

How To Get Started Investing In Your 30s For 30 39 Year Olds

How To Become Financially Independent In Your 30s The Humble Penny

2

Consumers Can Handle Fed Tightening Their Debts Delinquencies Foreclosures Collections And Bankruptcies Wolf Street

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor

30 Diy Disney Crafts For A Disney Vacation Poofy Cheeks Disney Crafts For Adults Disney Crafts For Kids Disney Diy