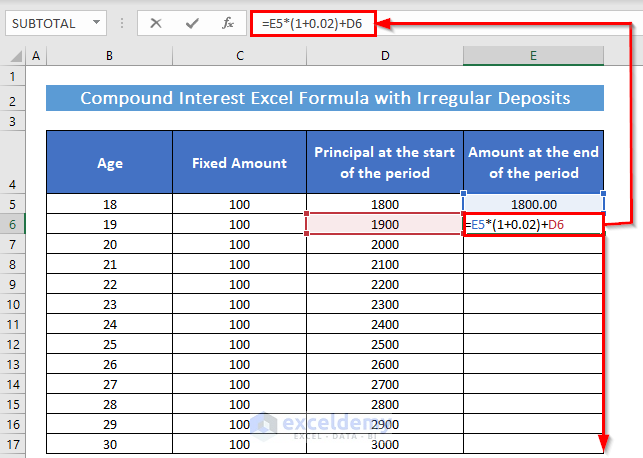

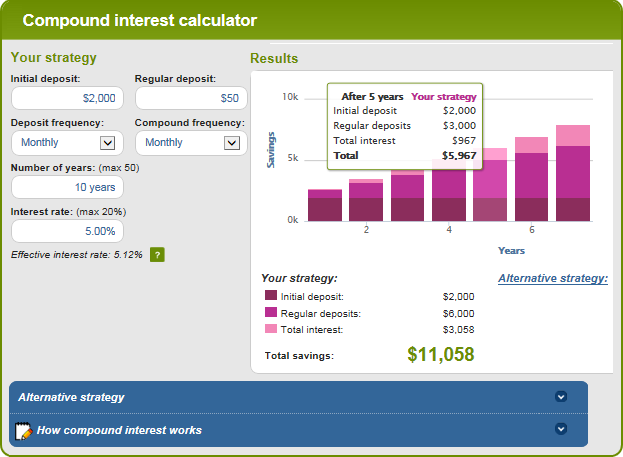

Compound interest calculator with variable deposits

Calculate Monthly Compound Interest Manually in Excel Using the Basic Formula. Interest rate is the amount charged expressed as a percentage of principal by a lender to a borrower for the use of assets.

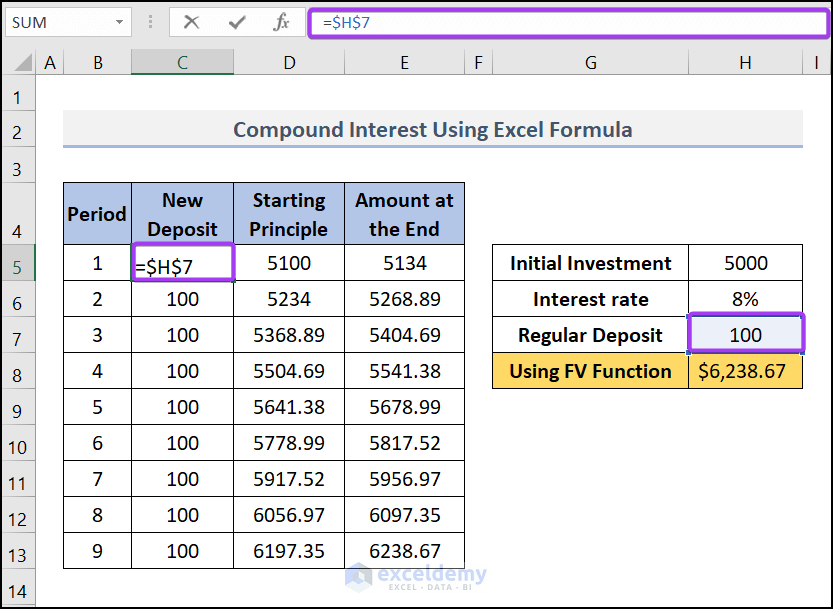

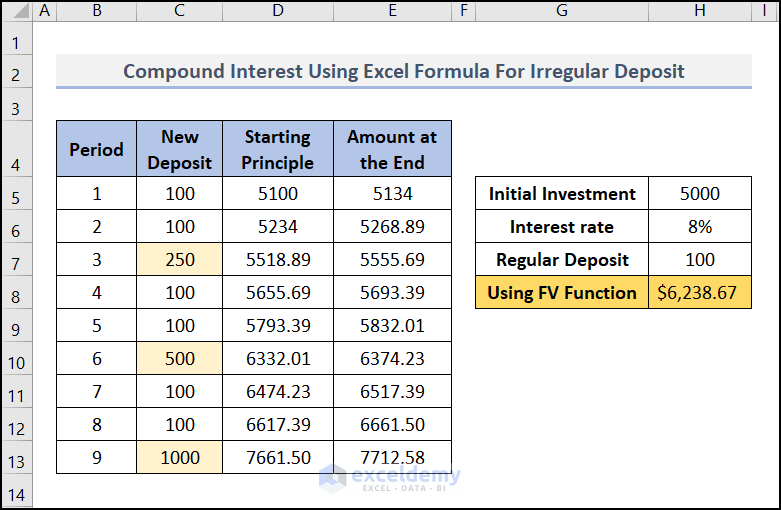

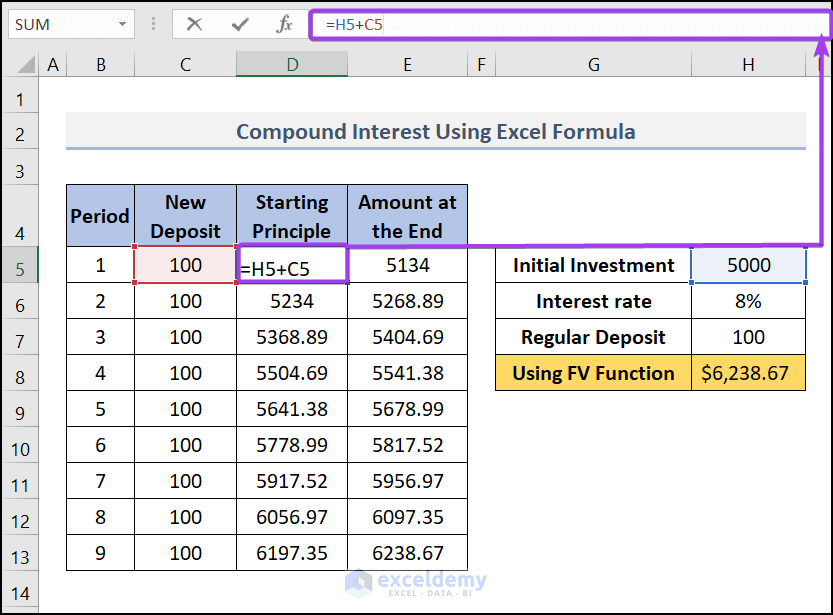

Excel Formula To Calculate Compound Interest With Regular Deposits

Term deposit interest rates are fixed but they tend to vary depending on the term you choose thats how long you deposit your money for.

. Term deposits earn very similar interest rates to savings accounts and are heavily tied to the cash rate. 1 Interest is calculated daily on the total daily balance and paid monthly. Interest rates are typically noted on an annual basis known as the.

Over the long-term this earns you interest on the interest on your savings and boosts your returns. GPF Interest CPF Interest and similar Provident Fund Interest for the year 2011-12 Provident Fund and other similar funds shall carry interest at the rate of 8 Eight per cent for the period from 142011 to 30112011 and 86 eight point six percent with effect from 1122011. Variable Rates change with.

For example if the simple interest rate is 5 on a loan of 1000 for a duration of 4 years the total simple interest will come out to be. Suppose a client borrowed 10000 at a rate of 5 for 2 years from a bank. Visit cdicca for information on eligible deposits.

Compound Annual Growth Rate - CAGR. The secret to saving success is compound interest. Some mortgages start out as trackers and after a few years become standard variable-rate mortgages.

2 Manulife Bank is a member of the Canada Deposit Insurance Corporation CDIC which means your deposits are eligible for CDIC deposit insurance protection. How KiwiSaver works and why its worth joining. The frequency of payment.

In general commissions for variable annuities average around 4 to 7 while immediate annuities average from 1 to 3. Once you have determined the amounts of each variable insert them into the compound interest formula to determine the interest earned over the specified time scale. For example a variable annuity with a 10-year surrender charge period will pay a higher commission than one with a 5-year surrender charge which results in a higher commission fee for the investor.

CD Calculator Compound Interest Calculator. Dive even deeper in Banking. At Ally Bank we compound interest daily giving your savings an advantage over deposit accounts that compound interest just quarterly or annually.

Rate is subject to change without notice. Most banks in the UK favor variable-rate mortgages in one form or another. It offers an ongoing 1224 variable APR but it also comes with an annual fee of 49.

How to pick the right KiwiSaver fund. This function can be used to calculate the principal. Therefore there are a wider variety of mortgages of this type in the UK.

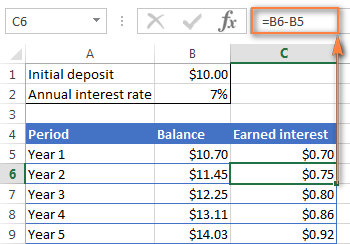

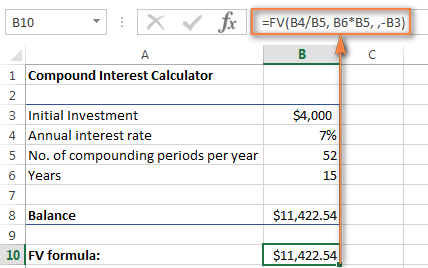

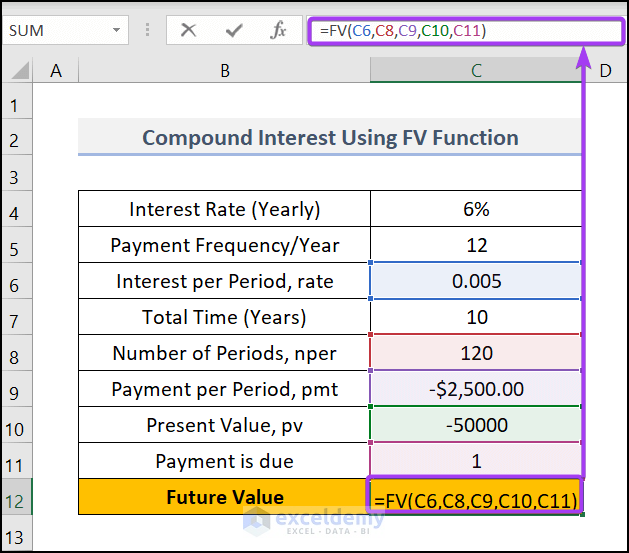

In this method well use the basic mathematical formula to calculate monthly compound interest in Excel. The compound annual growth rate CAGR is the mean annual growth rate of an investment over a specified period of time longer than one year. Make sure the interest is calculated daily so you can benefit from compound interest.

Interest is calculated on the daily closing balance and posted to your account monthly. Given Australias record-low cash rate youll struggle to find a term deposit paying over 200 pa. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings.

Dont have a mortgage and want to find out what your repayments could be and how long it could take to pay it off. Best Savings Accounts of September 2022. For example using the values P1000 r005 5 n4 compounded quarterly and t1 year we get the following equation.

Compound interest is calculated not just on the basis of the principal amount but also on the accumulated interest of previous periods. Advantages and disadvantages to 3 6 and 12 month term deposits Advantages. 3 Formulas to Calculate Monthly Compound Interest in Excel Formula 1.

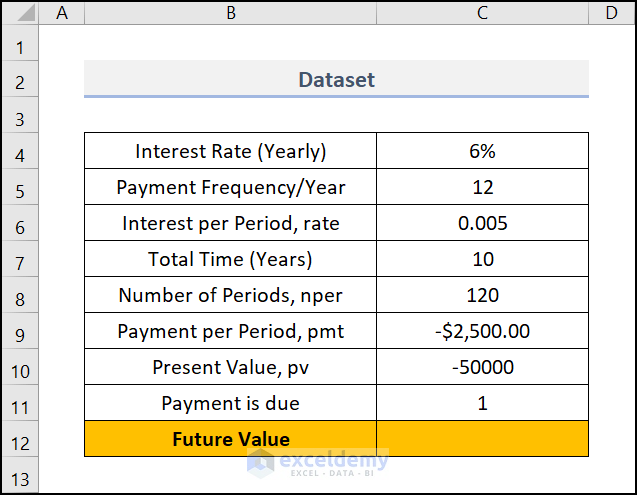

We can calculate the equated monthly amount in excel using the PMT function Using The PMT Function The PPMT function in Excel is a financial function that calculates the payment for a given principal and returns an integer result. APY annual percentage yield. 4 Manulife Bank Prime Rate is a variable rate and subject to change without notice.

3 Fixed-rate sub-account interest is compounded semi-annually not in advance. This calculator works out how much a regular. Your effective annual interest rate including compounding interest dictates how much you will effectively earn on a savings account over one year.

Annual interest and large security deposits. This is the reason why. Introductory tracker rates can be among the lowest mortgage interest rates available.

5 x 1000 x 4 200. What It Is and Why It Matters. With a 3 6 or 12 month term deposit you will typically receive your interest earnings once the account reaches maturity.

A 1000 1 005 4 4 1 displaystyle A. The majority of Australian savings accounts that provide compound interest allow you to make withdrawals and additional deposits whenever you need to. 5 Variable-rate interest is compounded monthly not in advance.

Interest paid calculated daily.

Compound Interest Formula And Calculator For Excel

Pin On Best Infographics

Compound Interest Formula And Calculator For Excel

Excel Formula To Calculate Compound Interest With Regular Deposits

Excel Formula To Calculate Compound Interest With Regular Deposits

How To Calculate Compound Interest For Deposits And Repayments Interest Rates Mozo

Excel Formula To Calculate Compound Interest With Regular Deposits

Compound Interest Formula And Calculator For Excel

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Excel Formula To Calculate Compound Interest With Regular Deposits

Ex Compounded Interest Formula Determine Deposit Needed Present Value Youtube

Excel Formula To Calculate Compound Interest With Regular Deposits

Future Value Of Varying Amounts And Time Periods Accountingcoach

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator Certificates Of Deposit Mathematics For The Liberal Arts Corequisite

Compound Interest Formula And Calculator For Excel

Compound Interest Definition Formula How It S Calculated